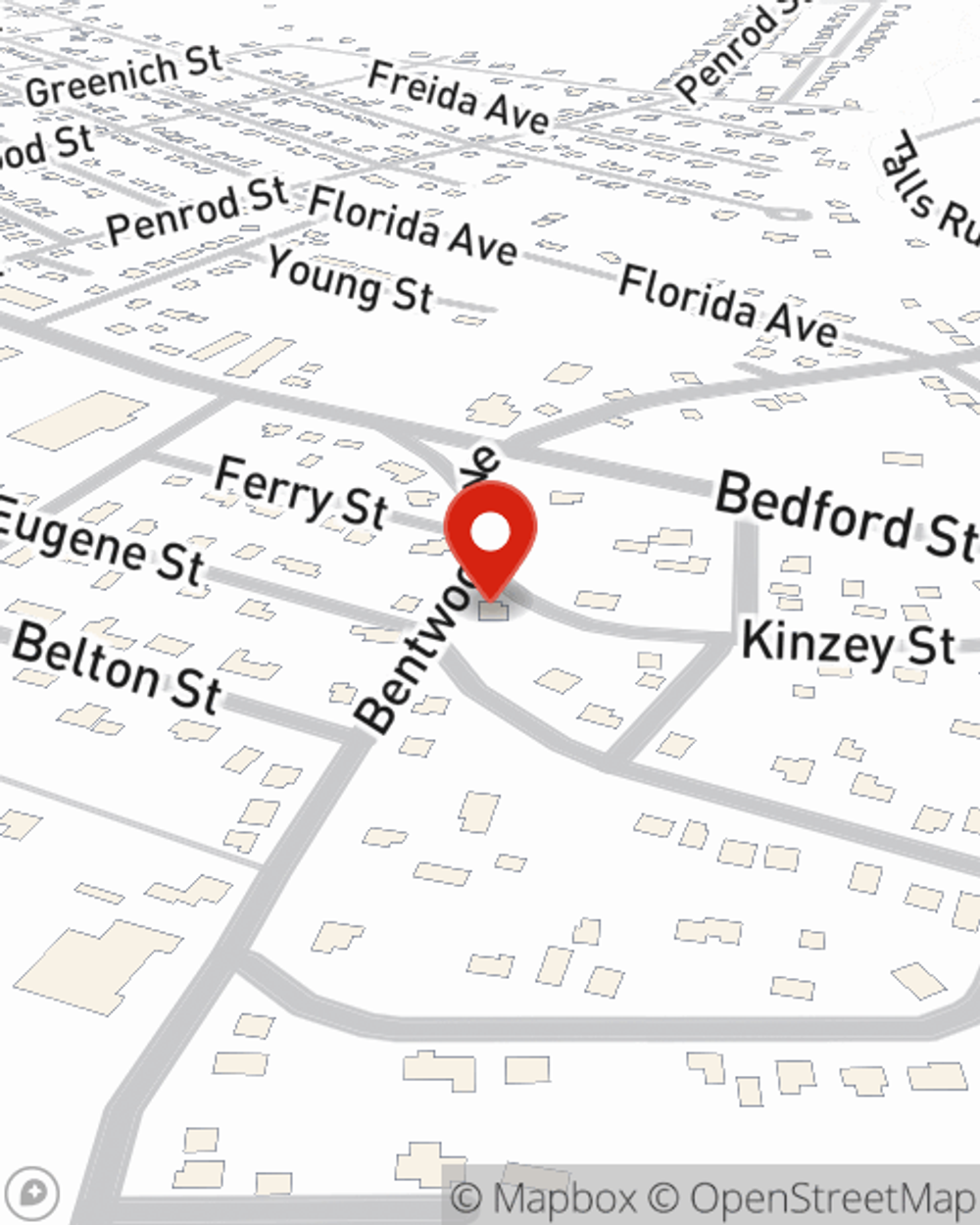

Business Insurance in and around Johnstown

Calling all small business owners of Johnstown!

Insure your business, intentionally

Help Protect Your Business With State Farm.

Preparation is key for when an accident happens on your business's property like a customer slipping and falling.

Calling all small business owners of Johnstown!

Insure your business, intentionally

Small Business Insurance You Can Count On

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like worker's compensation for your employees and extra liability. Terrific coverage like this is why Johnstown business owners choose State Farm insurance. State Farm agent Bill Weber can help design a policy for the level of coverage you have in mind. If troubles find you, Bill Weber can be there to help you file your claim and help your business life go right again.

Intrigued enough to investigate the specific options that may be right for you and your small business? Simply contact State Farm agent Bill Weber today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Bill Weber

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.